Why Your Winter Garden Down Payment Might Be Closer Than You Think

Why Your Winter Garden Down Payment Might Be Closer Than You Think

Buying a home in Winter Garden is exciting. You picture the sunshine, strolls through historic Downtown, weekends at the farmers market, and quick trips to Disney. But then, that one thought creeps in.

“How will I ever save enough for the down payment?”

“I need a fortune just to get started.”

“Guess I’ll be renting forever.”

If that sounds familiar, you’re not alone. The good news is, what you’ve heard about down payments may not be the whole story. And once you know the truth, you might realize you’re a lot closer to owning a Winter Garden home than you think.

Let’s clear up some of the biggest myths.

Myth 1: “I need a huge down payment.”

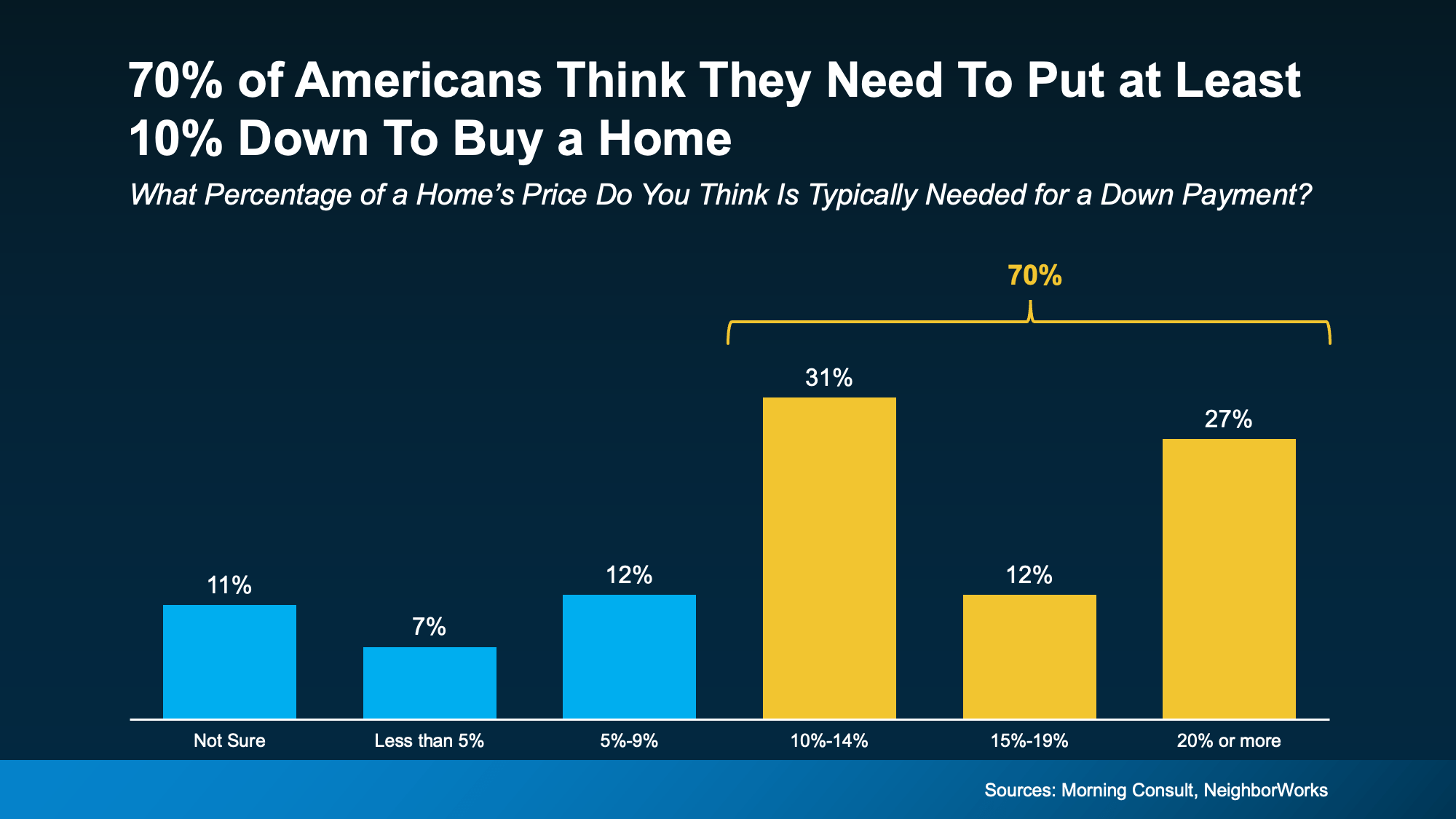

A lot of buyers believe this. In fact, a recent poll from Morning Consult and NeighborWorks found that 70% of Americans think they need at least 10% down to buy a home. Take a look at the bar chart below most people simply don’t realize there are lower options.

Here’s the truth:

The National Association of Realtors reports that first-time buyers have typically put down between 6% and 9% since 2018.

FHA loans can require as little as 3.5% down.

VA loans often require no down payment at all.

If you’ve been holding back because you thought you needed a mountain of cash, the reality might surprise you.

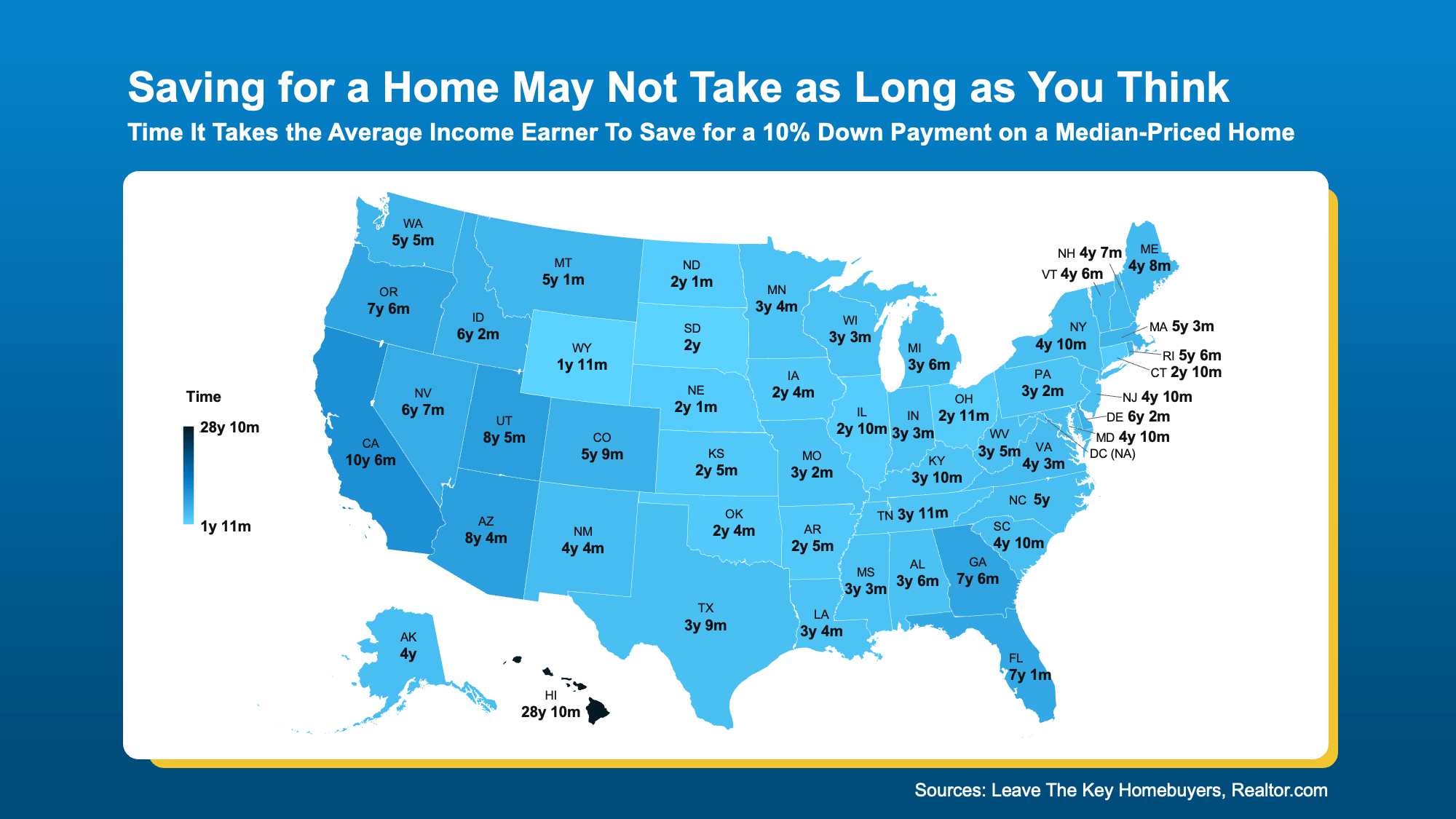

Myth 2: “It will take forever to save.”

Sure, saving takes effort. But maybe not as much time as you think. The map below shows how long it takes the average earner in each state to save for a 10% down payment. In Florida, the average is just over seven years. And remember, if you qualify for a lower down payment program, that timeline can shrink dramatically.

Plus, there are ways to speed things up:

Set up automatic savings deposits.

Direct bonuses or tax refunds straight to your home fund.

Explore side income opportunities here in Winter Garden’s growing job market.

Whatever it is, the way you tell your story online can make all the difference.

Myth 3: “I have to do it all alone.”

This is one of the biggest misconceptions. There are thousands of down payment assistance programs across the country, including options right here in Orange County. Yet, 39% of people don’t even know they exist.

These programs are designed for buyers just like you: ready to own, but needing a little help with the upfront costs. They can make the difference between waiting years and getting your keys much sooner.

Bottom Line

If the down payment is what’s been holding you back from buying a Winter Garden home, it might be time to rethink the plan. You may not need as much as you thought, and you don’t have to figure it out on your own.

Let’s talk about your options, your timeline, and how soon we can start finding that ideal place. Perhaps it’s near Hamlin, in Horizon West, or steps from historic Downtown.

The sunshine is waiting. So is your new front porch.