When Will Mortgage Rates Come Down?

Mortgage rates have been a focal point for prospective homebuyers and homeowners alike, especially given their significant rise over the past year. Understanding the factors influencing these rates and anticipating their future trajectory is crucial for making informed decisions in the housing market.

Current Mortgage Rate Landscape

As of December 2024, the average 30-year fixed mortgage rate stands at approximately 6.69%, a decrease from the previous week's 6.81% and down from 7.03% a year ago. This decline is influenced by various economic factors, including the Federal Reserve's monetary policies and broader economic conditions.

Factors Influencing Mortgage Rates

-

Federal Reserve Policies: The Federal Reserve's decisions on interest rates play a pivotal role in shaping mortgage rates. Recent rate cuts by the Fed have contributed to the current downward trend in mortgage rates.

-

Economic Indicators: Indicators such as inflation rates, employment figures, and overall economic growth impact mortgage rates. For instance, a cooling inflation rate can lead to lower mortgage rates.

-

Bond Market Dynamics: Mortgage rates often move in tandem with the yields on U.S. Treasury bonds.Fluctuations in the bond market can directly affect mortgage rate trends.

Projected Trends for Mortgage Rates

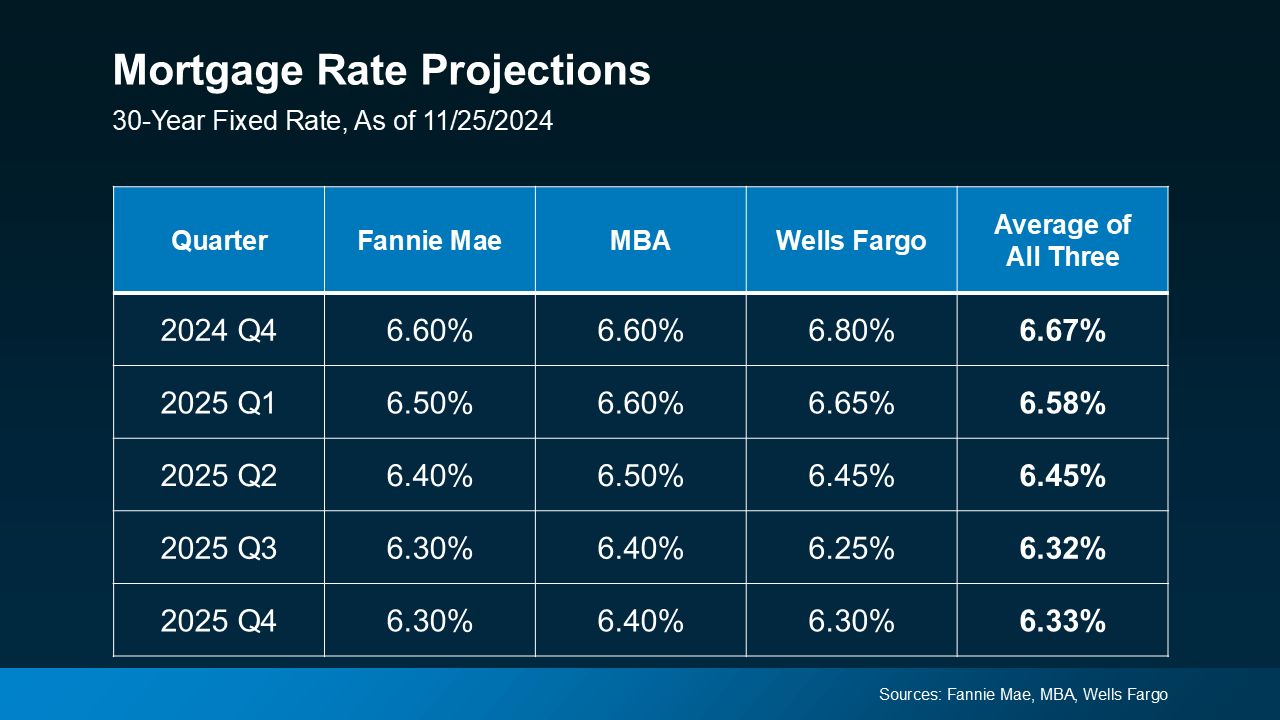

Industry experts anticipate a gradual decline in mortgage rates over the next year. Fannie Mae forecasts the 30-year fixed mortgage rate to average 6.0% in the final quarter of 2024, with a further decrease to 5.9% in the first quarter of 2025. Similarly, the Mortgage Bankers Association projects the 30-year fixed-rate mortgage to average 6.3% in the fourth quarter of 2024, continuing a downward trend into 2025.

Implications for Homebuyers and Homeowners

-

For Prospective Homebuyers: The anticipated decline in mortgage rates could enhance affordability, making it an opportune time to consider entering the housing market.

-

For Current Homeowners: Those with higher-rate mortgages might find refinancing beneficial as rates decrease, potentially leading to significant savings over the loan's lifespan.

Conclusion

While mortgage rates are expected to decline gradually, the exact timeline remains uncertain due to various influencing factors.Staying informed about economic trends and consulting with financial professionals can aid in making well-informed decisions regarding home financing.

Note: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making significant financial decisions.

Recent Posts

GET MORE INFORMATION